Is Renters Insurance Worth It?

When you rent an apartment, your landlord is responsible for insuring the building, taking care of necessary structural repairs, and covering any injuries that directly result from issues related to the building itself.

However, renters play a role in insuring their home with their own policy, as well. Yet, many renters believe that renters insurance is an unnecessary cost to add to their monthly bills.

If you're wondering whether renters insurance will be a benefit to you, keep on reading!

What is renters insurance?

Renters insurance is similar to homeowners insurance but without the dwelling or structural coverage.

It’s designed to protect the renter from burdensome out-of-pocket expenses when an unexpected event occurs such as a fire or robbery.

The covered expenses on renters insurance policies typically include the replacement of personal property, loss of use when displaced from your home and daily routine, and liability when you may be responsible for someone’s injury that happened in your home.

When an unexpected covered event occurs, you file a claim with your provider and start receiving benefits according to the agreed-upon amounts.

Should a tenant invest in renters insurance?

Renters insurance may be necessary if your landlord requires it upon move-in (obviously). Landlords often make having your own policy mandatory because they don’t want to be held responsible if someone gets injured in their tenant’s home.

However, the tenant benefits from the renters insurance policies as well by having their items protected from an event that may not fall under the landlord’s insurance.

Even if your landlord doesn’t require you to have your own policy, it can be worth it for your peace of mind and for protecting yourself from the financial burden of unexpected losses in the future.

The good news is that there are some reasonably priced policies offered by trusted providers if you don’t want to commit too much money at first.

At Lighthouse, we offer renters insurance for as little as $10 per month. The best part is that adding a policy can be done in a matter of minutes! It's affordable, and it'll give you peace of money- knowing that your home is insured in the case of an emergency.

What's covered under the renters insurance?

Three main categories are covered by renters insurance policies from certain events.

Any loss or expense under these categories occurring from an included event will be paid up to a certain amount. If you want additional options for coverage, most providers offer add-ons for your policy called endorsements that are great for renters looking for extra peace of mind.

Listed below are the basic categories included in most standard policies:

Loss of Use

This kind of coverage is paid out if you have any extra expenses to pay for after a covered event. For example, if you’re displaced from your home and have to pay for a hotel room and extra meals, your renters insurance would cover those costs.

Personal Property

Personal property coverage is the most important category for many people since it gives renters peace of mind that their belongings will be replaced after a covered unexpected incident. There are typically two options when selecting your policy: actual cash value (ACV) and replacement cash value (RCV). ACV policies are typically cheaper since they only cover the depreciated value amount of your personal items.

Liability

Liability coverage pays for expenses that could arise if you’re held responsible for someone else’s injury that occurred in your home. Liability insurance will take care of both medical expenses and legal fees if necessary. Some policies will cover medical payments for injuries that occur in your home, even if you’re not at fault.

Different renters insurance policies will cover different items. However, most policies usually cover:

- Fire

- Explosions

- Theft

- Smoke damage

- Falling objects

- Lightning or electrical damage

- Bad weather conditions like snow, sleet, hail, or ice

- Riots

How do you get renters insurance?

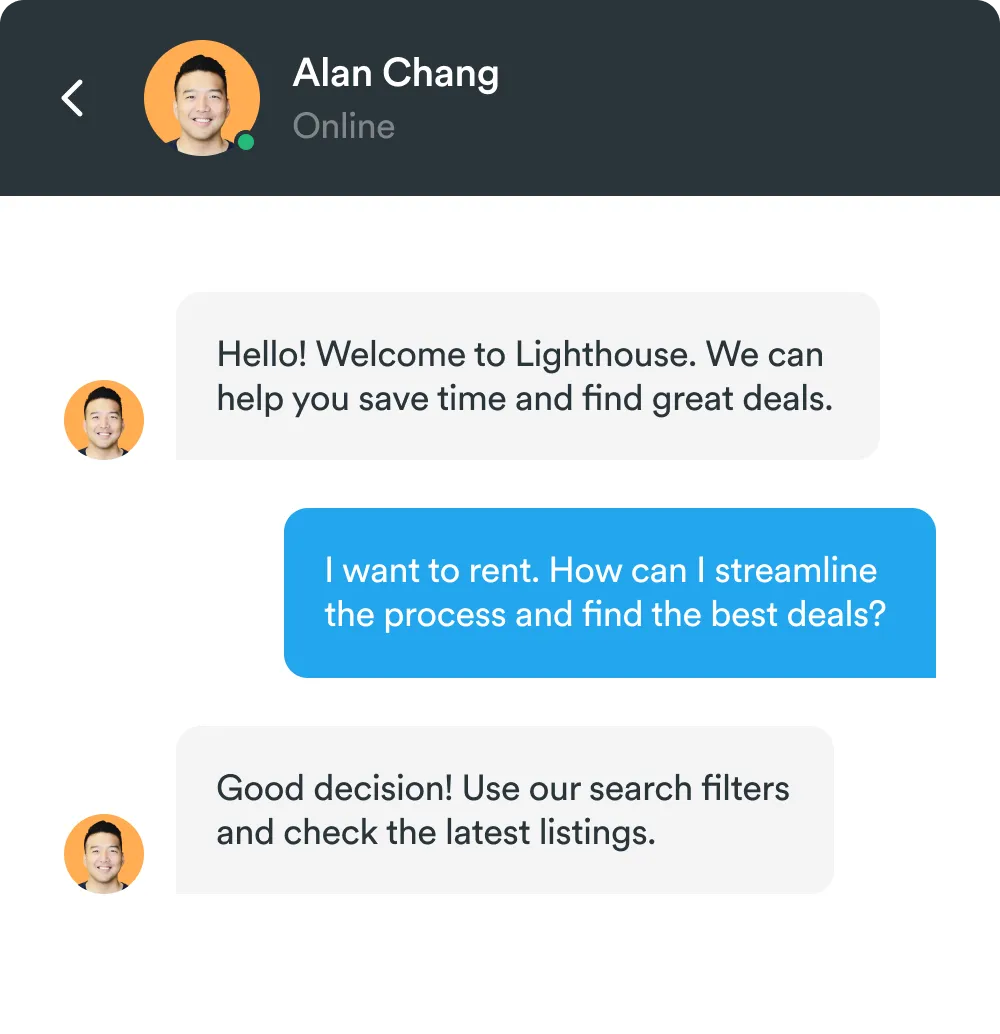

As we previously stated, Lighthouse made it part of its mission to offer renters cheap and accessible renters insurance.

For as little as $10 per month (or $120 per year), you can add a rental insurance policy.

Our platform allows you to add the policy from the comfort of your own home. It's an easy digital platform that allows you to select, purchase, update or cancel your policy whenever you'd like. Your profile is accessible through our online portal. The renters insurance also offers flexible coverage and gives you a cheap insurance option so that buying a renters insurance policy won't break your bank.

Conclusion

We hope this renters insurance guide helped you out! Share this with anyone looking to get $10 renters insurance.

If you or anyone you know is looking to move into a new place, you should give us a look. Lighthouse gives cash back to renters who sign a new lease. It's an easy way to save on rent (especially in this unaffordable market).

.svg)

.svg)